News on Behalf of Palm Beach County Property Appraiser's Office - September 2021 Newsletter

Palm Beach County Property Appraiser’s Office | September 2021 Newsletter

Dear Taxpayer:

Happy autumn!

My office once again asks that all visitors wear facial coverings and practice social distancing while indoors on County property. We continue to implement measures to ensure the health and safety of our staff, while also maintaining the highest level of safe service to the taxpayers of Palm Beach County.

By now, all property owners in Palm Beach County have received their 2021 Notice of Proposed Property Taxes and Assessments from my office. Remember this not a bill, but rather an estimate of your taxes based on the proposed tax rates, your property value and exemptions.

The next stage in the tax roll process is the petition filing period. Property owners have the option to appeal their property’s assessment or denial of portability before the county’s Value Adjustment Board (VAB), which is administered by the Clerk of the Circuit Court & Comptroller. Florida law sets the value petition filing period, which begins when the notices are mailed and ends 25 days later. This year’s deadline to file a petition is September 13, 2021.

Also highlighted in this month’s newsletter is the great news that our office has been awarded the Certificate of Excellence in Assessment Administration from the International Association of Assessing Officers. I am so proud that our office has achieved this prestigious recognition in service to you, the people of Palm Beach County.

Respectfully,

Dorothy Jacks, CFA, AAS

Palm Beach County Property Appraiser

We Value What You Value

The Value Adjustment Board Process

If you feel that the market value of your property is inaccurate or does not reflect fair market value as of January 1, 2021, or you are entitled to an exemption or classification that is not reflected on the 2021 Notice of Proposed Property Taxes, contact our office for an informal review. Call us at 561.355.3230 and we will connect you with an appraiser or exemption specialist to discuss your concerns. If we are unable to resolve the matter, you have the right to file a petition for adjustment with the Value Adjustment Board (VAB).

The VAB is administered by Palm Beach County's Clerk of the Circuit Court & Comptroller, which is independent of the Property Appraiser’s Office. The Board is made up of five individuals: two from the county’s board of commissioners, one from the county’s school board, and two citizen members. They approve and use special magistrates who are experienced in property appraisal techniques or legal matters to conduct hearings and recommend decisions to the VAB for final approval. Special Magistrates will review property valuation, denials of portability, deferrals, and change of ownership or control determinations. All final rulings are determined by the VAB.

Filing a Petition

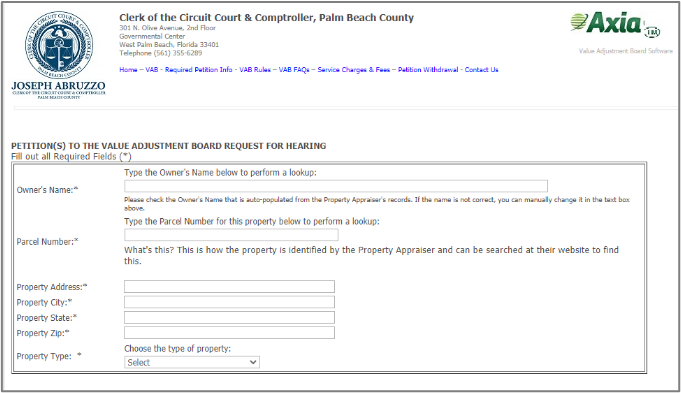

Florida law sets the deadlines for filing a petition on or before the twenty-fifth day following the mailing of the notice from our office. This year’s deadline is September 13, 2021. These deadlines do not change, even if you choose to discuss the issue with our office. The VAB may charge $15+ for filing a petition.

PDF petition forms are available on our website or online petition filing is available through the Clerk of the Circuit Court & Comptroller.

Once a petition is filed, you will receive a notice with the date, time, and location of your hearing at least 25 days before your hearing date. You can reschedule your hearing once for good cause. If your hearing is rescheduled, the clerk will send notice at least 15 days before the rescheduled hearing.

Fifteen days prior to the scheduled petition hearing, you are required to provide our office with a list and summary of evidence that you will present at the hearing. You can submit your evidence electronically through the Clerk of the Circuit Court & Comptroller. Seven days before the VAB hearing, our office is required provide you with a list and summary of evidence, which will be presented at the hearing.

The Hearing

At the VAB hearing, you may represent yourself or seek assistance from a professional. Some examples of professional representation might include an attorney, a licensed real estate appraiser or broker, or a certified public accountant. If someone who is not a licensed professional represents you, you must sign the petition or provide written authorization or power of attorney for your representative.

During the hearing, a special magistrate will ask you to present your evidence and testimony in support of your petition. In most cases, to win a reduction in appraised value before the VAB, you must prove that the county's appraisal of your property exceeded market value and explain why. A representative from our office will then present evidence in support of the property valuation, denied exemption, etc., depending on the issue. You will have another opportunity to comment before the end of the hearing.

Keep in mind, although the decision of the magistrate is binding, the hearing itself is an informal process. The VAB will mail you a written copy of its final decision. Regardless of the outcome of your hearing, you must pay all or the required portion of your taxes by April 1 to keep your petition valid and avoid additional cost and fees.

After the Hearing

The VAB must issue all final decisions within 20 calendar days of the last day it was in session. You may file a lawsuit in circuit court if you do not agree with the VAB’s decision.

For more information about the VAB in Palm Beach County, email vab@mypalmbeachclerk.com or call them at 561.355.6289.

Property Appraiser’s Office Earns Certificate of Excellence

The Palm Beach County Property Appraiser’s Office has earned the Certificate of Excellence in Assessment Administration (CEAA) from the International Association of Assessing Officers (IAAO). This recognition is the highest professional honor for an assessment jurisdiction offered by the IAAO, as it recognizes those who utilize best appraisal and assessment practices in their offices.

“Achieving the CEAA was not easy,” said Palm Beach County Property Appraiser Dorothy Jacks, CFA, AAS. “But it simply underscores our commitment to providing the absolute best service to the people of Palm Beach County.”

According to one judge, Palm Beach County’s application for the CEAA was, “The best submission that I have graded… This could be a model for future CEAA applicants."

The CEAA evaluates an entire jurisdiction rather than an individual, and so the requirements place a strong emphasis on teamwork and group achievement. Jurisdictions that earn the CEAA demonstrate a high level of proficiency in the assessment and appraisal disciplines to both their constituents and their peers.

Holiday Office Closure

The Palm Beach County Property Appraiser's Office (including all of our Service Centers) will be closed in observance of Labor Day on Monday, September 6, 2021.